coface vs euler hermes | Report Finds A Strong Economic Recovery Relies on Safe and coface vs euler hermes Historical antecedents of trade credit insurance (and even of credit derivatives, more indirectly) date back at least to the 1860s, when Johns Hopkins endorsed the notes of persons and firms whom he judged to be worthy credit risks, for a price (of up to 5%), making it easier for a note bearer to discount a note, that is, to sell it to another firm or to a bank. This helped to increase the salability of commercial paper, which stimulated trade, especially in a world before credit cards. Hopkins . Shakeel 21. dec 2016 08:30. Shakeel 21. dec 2016 08:31. David Lodge 20. jan 2018 07:55. Lilija 5. okt 2021 22:54. David Lodge 20. jan 2018 08:51. Tas ir mans tēvs. Draugiem lietotājs 6. okt 2020 02:38. 29/09 2020 Apprece`ju .

0 · Trade credit insurance

1 · Top Atradius Competitors and Alternatives

2 · Top Allianz Trade Competitors and Alternatives

3 · Report Finds A Strong Economic Recovery Relies on Safe and

4 · Insurance Markets

5 · Industry Profile and Operating Environment: Global Trade Credit

6 · Euler Hermes: A World

7 · Euler Hermes is now Allianz Trade

8 · ECA Market Set for Explosive Growth

9 · Credit Insurers' Coronavirus Losses Mitigated by State Support

The following is a list of quests classified as Dragoon Quests from Final Fantasy XIV. Contents. 1Quests. 1.1Eye of the Dragon. 1.1.1Journal. 1.1.2Objectives. 1.2Lance of Fury. 1.2.1Journal. 1.2.2Objectives. 1.3Unfading Skies. 1.3.1Journal. 1.3.2Objectives. 1.4Double Dragoon. 1.4.1Journal. 1.4.2Objectives. 1.5Fatal Seduction. 1.5.1Journal.

Trade credit insurance

With 34% of market share, Euler Hermes is far ahead of its closest competitors, Atradius (a global market share of 20%) and Coface (18% of the global market share).Historical antecedents of trade credit insurance (and even of credit derivatives, more indirectly) date back at least to the 1860s, when Johns Hopkins endorsed the notes of persons and firms whom he judged to be worthy credit risks, for a price (of up to 5%), making it easier for a note bearer to discount a note, that is, to sell it to another firm or to a bank. This helped to increase the salability of commercial paper, which stimulated trade, especially in a world before credit cards. Hopkins .

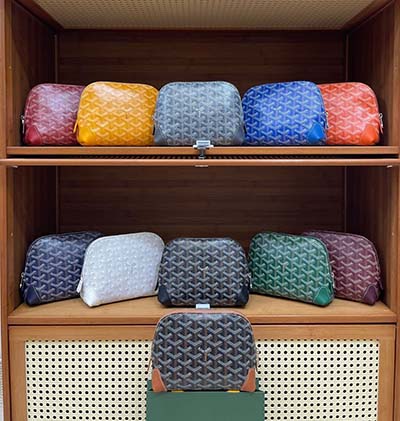

coco chanel moiselle

The credit insurance market is estimated at around .0 billion premium by the International Credit Insurance and Surety Association. Historically the portfolio market has been dominated . Euler Hermes, Coface and Atradius are the world's three largest trade credit insurers, representing about 60% of the market in the U.S. Examples of these include public export credit agencies or government-supported TCIs.Regulatory OversightRegulatory oversight of the three largest global trade credit insurers .

Regulatory oversight of the three largest global trade credit insurers (Euler-Hermes, Atradius, Coface – all EU based), is very developed and transparent with effective . The three leading global credit insurers, Atradius, Coface and Euler Hermes, which account for the bulk of the global market, entered the crisis with very strong regulatory capital .

Atradius's main competitors include Sava Re, Zurich Insurance Group, Coface, Intrum Justitia and Allianz Trade. Compare Atradius to its competitors by revenue, employee growth and other .Some of the key players profiled in the study are Euler Hermes, Sinosure, Atradius, Coface, Zurich, Credendo Group, QBE Insurance & Cesce. The global Credit Insurance market was valued at US,610 million in 2021 and is projected to reach US,500 million by 2028.Allianz Trade's main competitors include Atradius, Coface, Dimont and ARAG. Compare Allianz Trade to its competitors by revenue, employee growth and other metrics at Craft.

With 34% of market share, Euler Hermes is far ahead of its closest competitors, Atradius (a global market share of 20%) and Coface (18% of the global market share).Euler Hermes, merger of the two credit insurance companies of the Allianz Group. Euler Hermes is the world's number one credit insurance provider. [3] Coface, a wholly owned subsidiary of .The credit insurance market is estimated at around .0 billion premium by the International Credit Insurance and Surety Association. Historically the portfolio market has been dominated . Euler Hermes, Coface and Atradius are the world's three largest trade credit insurers, representing about 60% of the market in the U.S.

Examples of these include public export credit agencies or government-supported TCIs.Regulatory OversightRegulatory oversight of the three largest global trade credit insurers . Regulatory oversight of the three largest global trade credit insurers (Euler-Hermes, Atradius, Coface – all EU based), is very developed and transparent with effective . The three leading global credit insurers, Atradius, Coface and Euler Hermes, which account for the bulk of the global market, entered the crisis with very strong regulatory capital .Allianz Trade's main competitors include Atradius, Coface, Dimont and ARAG. Compare Allianz Trade to its competitors by revenue, employee growth and other metrics at Craft.

Euler Hermes's top competitors include Atradius, Coface and Allied World. See the full list of Euler Hermes alternatives and competitive updates on Owler, the world’s largest community-based .Atradius's main competitors include Sava Re, Zurich Insurance Group, Coface, Intrum Justitia and Allianz Trade. Compare Atradius to its competitors by revenue, employee growth and other . With 34% of market share, Euler Hermes is far ahead of its closest competitors, Atradius (a global market share of 20%) and Coface (18% of the global market share).

Euler Hermes, merger of the two credit insurance companies of the Allianz Group. Euler Hermes is the world's number one credit insurance provider. [3] Coface, a wholly owned subsidiary of .The credit insurance market is estimated at around .0 billion premium by the International Credit Insurance and Surety Association. Historically the portfolio market has been dominated . Euler Hermes, Coface and Atradius are the world's three largest trade credit insurers, representing about 60% of the market in the U.S. Examples of these include public export credit agencies or government-supported TCIs.Regulatory OversightRegulatory oversight of the three largest global trade credit insurers .

Regulatory oversight of the three largest global trade credit insurers (Euler-Hermes, Atradius, Coface – all EU based), is very developed and transparent with effective . The three leading global credit insurers, Atradius, Coface and Euler Hermes, which account for the bulk of the global market, entered the crisis with very strong regulatory capital .Allianz Trade's main competitors include Atradius, Coface, Dimont and ARAG. Compare Allianz Trade to its competitors by revenue, employee growth and other metrics at Craft.Euler Hermes's top competitors include Atradius, Coface and Allied World. See the full list of Euler Hermes alternatives and competitive updates on Owler, the world’s largest community-based .

Top Atradius Competitors and Alternatives

Top Allianz Trade Competitors and Alternatives

coco chanel mademoiselle comprar

Report Finds A Strong Economic Recovery Relies on Safe and

A lot of people have been wondering how to level up fast in Dragon Ball Xenoverse 2. Every time the level cap increases it’s a race to increase your level as fast as possible. However, with the massive amount of XP required to increase you level it can take a while to do so. Thankfully we’ve created this Dragon Ball Xenoverse 2 leveling .

coface vs euler hermes|Report Finds A Strong Economic Recovery Relies on Safe and